While new subsea resident drone technologies are now being proven, demonstrated and the first contracts awarded, it’s still far from clear what the actual commercial future will be.

The idea is attractive; having subsea robots permanently based subsea, reducing the need for people and expensive vessels offshore and the emissions that involves. According to Oceaneering, yearly CO2 emissions of an remotely operated underwater vehicle (ROV) vessel are about 25,500 metric tons. Dropping off one of its E-ROVs on a temporary mission would cut that to 3,600 metric tons. Using a permanently deployed vehicle, such as its Freedom vehicle, would cut it to 500 metric tons. It’s also perhaps inevitable as executives look across their businesses for opportunities to modernize and make efficiencies through digitalization, automation and remote operations. For Equinor, this is an enabler for subsea factories. For others, it’s about time ROVs came into the 21st century. TechnipFMC CTO Justin Rounce, for example, told Offshore Europe that ROV technology hasn’t changed in decades. It’s time to start using technologies like computer vision in this arena, he says.

Steps have been made. Remote control of ROV systems is already being done.

Vendors have also made huge strides in developing new vehicle systems for what seems like a hungry market. Last year saw subsea electric robotics firm Saab Seaeye demonstrate its Sabertooth autonomous underwater vehicle (AUV) perform inductive charging and communication on Equinor’s subsea docking station (SDS) — something the Norwegian operator hopes will help encourage take up of this technology, allowing vendors to focus on the vehicle development, if everyone agrees to use the same docking design (Equinor has been working with the Subsea Wireless Group, i.e. SWiG, and Deepstar, on wireless and mechanical standards for these).

Standardization could open up the possibility to provide an Uber AUV — or on-demand subsea robotics — service. Pål Atle Solheimsnes, Leading Advisor Subsea Intervention, Diving and Pipeline Repair, told Offshore Europe, “The plan with the UiD (underwater intervention drone) is that it should be an Uber service. We want to share with other licenses, 1, 2, 3, that service a whole area. We just have to first test them out and get the docking station in place and then we will offer that service. That’s part of the big plan.” Chevron’s John Brian made a similar comment at the same event. “What about UiD Uber? Basin-wide, companies invest in resident robots that everyone can then pull up on their app and see which are available?”

So what has been done? There’s lots of work going into having robots for permanent subsea service. US subsea services and technology firm Oceaneering has been ploughing work into its Freedom vehicle, a scale version of which has been used for intensive software development in Norway and was then also demonstrated performing docking on the SDS, using acoustics, visual markers and machine vision, and the magnetic field of an inductive connector to home in to the docking plate. Offshore trials of a full-scale vehicle on a UK pipeline inspection project are expected this year before it goes into commercial operation. Meanwhile, Saipem, has been working hard on its HyDrone series of vehicles, one of which is set to be deployed at Equinor’s Njord field under a commercial contract this year. Another firm, Subsea 7, has its autonomous inspection vehicle (AIV), which has performed a structured inspection of a subsea tree in “complete autonomous mode”, having navigated there on its own.

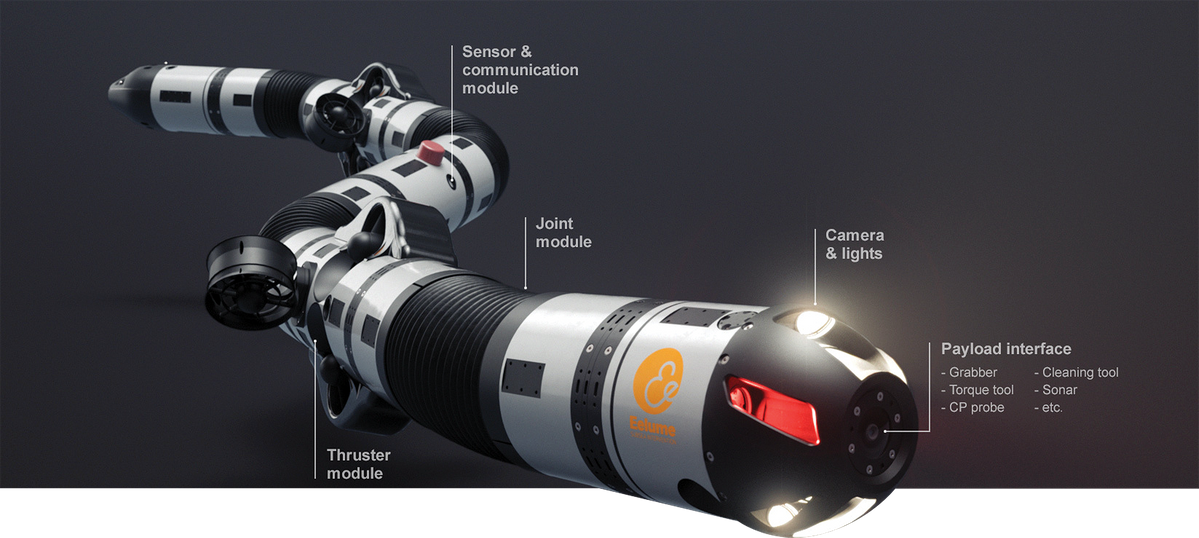

Much — but not all — of this activity has been spurred on by Equinor, which paid for SDS to be built, with one installed at a test site off Trondheim, one due at the Åsgard field, to test a tethered version of another concept — Eelume, built by a Trondheim based company — and the third being used for testing by Saipem ahead of its deployment. The firm is understood to be looking at having seven on the Snorre expansion project in order to install resident drones. Rune Aase, VP at Equinor, told a drone demonstration event, organized by Stinger AS, a specialist subsea technology firm, in Norway last year, that other fields are being considered for UiDs, including Johan Sverdrup, Johan Castberg and Bay du Nord. “Then there are all the brownfields that should be supported by some drones and we need to look into how we’re going to do that.”

For this to happen, infrastructure needs to be in place — such as power networks, to recharge vehicles — and subsea equipment needs to be vehicle friendly. Looking ahead, to a world where different vendor vehicles can dock in different docking stations, how will how they connect into different data and control networks be managed? This is something Jan Christian Torvestad, from Equinor, has been considering.

“If I have a cell phone with Norwegian subscription I can still travel to America and use it, even if the service is provider not there — we have agreements. With a standardized docking station, I can get power, and communication and then a service provider making sure that if a drone docking on an Equinor docking station is connected to the correct control room,” he says. “If it goes to a Shell docking station, will it still get the same control room? The service IT and architecture in the background needs to be considered. It’s part of the puzzle. It could be an equivalent of a SIM card, proving who connects, and then a dynamic flow of data to where it needs to go; the cloud, control room, operator, etc.”

How do you then prioritize bandwidth and ensure data security? How does this work commercially; there may even be fees for a vehicle to dock and charge at different docking stations, he suggests. Answer these questions and “then you can have the Uber AUV and high utilization because you can switch from one mission to another and between companies,” says Torvestad. “Just imagine if we have sufficient number of operators one the NCS (using drones) where we get a critical mass and manage standardisation mechanically, electrically and in IT.” That’s assuming that everyone is happy to go along with the same standardised docking stations.

Even then, will the commercial models work? Success of this concept could result in some significant changes in how subsea operations are done. “We are on the edge of some really big changes in our industry,” said Stephen Gray, CEO at UK based ROV services firm ROVOP, during Subsea UK’s Underwater Robotics conference in Aberdeen. Gray suggests that the change will reflect a change that’s already happened in other industries, such as telecommunications (think mobile phones and what happened to Nokia when Apple came out of nowhere).

Which leaves further questions. Jim Jamieson, Strategy and Technology, Development Manager

There are also other approaches that could be taken. While Rounce was keen to promote the advancement of subsea vehicles, his company has also been embedding robotics — or more specifically mechatronics — into subsea infrastructure. In August 2018, TechnipFMC, which took over manipulator and ROV manufacturer Schilling Robotics through its acquisition of FMC Technologies in 2017, installed a compact robotic manifold in Brazilian four slot water alternating gas manifold. A robotic arm was later installed. It can operate 30 valves (that would otherwise each need an actuator) and can do 30,000 cycles, says Rounce. The robotic arm was operated for four to five months without issue and was then retrieved to measure the impact of a long-term deployment in then subsea environment. It was due to be reinstalled later in 2019. A second manifold is also being installed. “I think we are only scratching the surface of opportunities in these areas,” says Rounce.

That would open up another take on the resident robotics theme. Which concept — even amount the resident systems, vehicles and even docking stations — wins out is yet to be seen. While Equinor has promoted its vision, other operators have not been so vocal. The risk is that they come out with different requirements and that no single vehicle meets the requirements of a single operator. Which would limit the market. “It would be interesting to see in 10 years if anyone was right,” says Lindsø. Indeed.