2023 Market Outlook

Carbon Capture & Storage

Carbon Capture and Storage - an Emerging Offshore Industry

We are heading towards 2.2°C of global warming - the uncomfortable conclusion of DNV’s recent Energy Transition Outlook report. Closing the gap between our current 2.2°C trajectory and the 1.5°C future we need requires significant deployment of carbon capture and storage (CCS) technologies.

By Jamie Burrows, Head of Business Development – CCUS, Energy Systems, DNV

We are heading towards 2.2°C of global warming - the uncomfortable conclusion of DNV’s recent Energy Transition Outlook report.

Closing the gap between our current 2.2°C trajectory and the 1.5°C future we need requires significant deployment of carbon capture and storage (CCS) technologies. CCS is required to decarbonize hard-to-abate industry and hydrogen production, but can also be used to address entrained CO2 produced with hydrocarbons.

Reflecting growing recognition of its importance, the CCS project pipeline has grown significantly in recent years. The Global CCS Institute’s 2022 annual status report shows that 61 facilities were added to the pipeline in the last 12 months, taking the total in operation and development to 191 and representing an annual capture capacity of 244 million tonnes.

Many projects in development plan to store CO2 offshore. The first facility to do so was Equinor’s Sleipner in Norway. Following the 1991 introduction of a tax on offshore emissions, it was recognized that returning CO2 produced with natural gas to the geosphere would be both environmentally beneficial and economic. Operating since 1996, Sleipner has now stored over 20 million tonnes of CO2 deep beneath the seabed in the Utsira formation.

Today, a new Norwegian project - Longship, and its transport and storage facility, Northern Lights represent a major milestone for global CCS deployment. Currently in construction, the project will be the first to use ships to transport CO2. This will enable emissions to be captured from industrial sources across Northwest Europe. Captured CO2 will be shipped to a receiving terminal in Øygarden and sent via a 100km pipeline to a location south of the Troll field where it will be injected to 2600m below the seabed. First injection is anticipated in 2024 and a second phase is currently in development.

Around the North Sea, many other CCS projects are emerging that plan to store CO2 offshore.

Some of the more mature ones are Greensand in Denmark, Porthos in the Netherlands, and the Northern Endurance Partnership in the UK.

As the storage facility for the East Coast Cluster, the Northern Endurance Partnership will store CO2 from industrial emitters in Teesside and Humber in the Endurance deep saline reservoir.

In Europe, avoidance of regional carbon taxes, as well as specific policy mechanisms, such as those being established in the UK and the SDE++ in the Netherlands, are enabling projects. In parallel, the potential to re-purpose hydrocarbon pipelines and depleted reservoirs can help to reduce Capex costs.

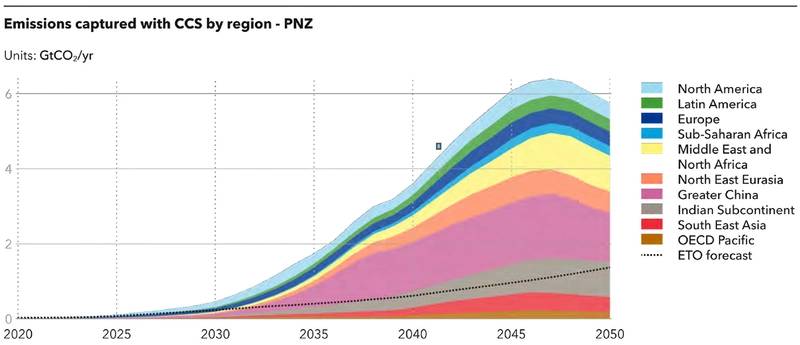

Emissions captured with CCS by region

While the greatest concentration of offshore CO2 storage projects is in Europe, this is by no means the only region where such projects are emerging. In recent years several projects have been announced in the Gulf of Mexico. The most ambitious of these will store emissions from refineries and industrial sources along the Houston ship channel. The Houston hub led by ExxonMobil is exploring plans to store 50 million tonnes of CO2 annually by 2030 and double that by 2040.

In Asia several projects have emerged that will store CO2 associated with offshore gas production. PTTEP is developing a CO2 storage facility as part of its major Lang Lebah gas development offshore Sarawak. It is estimated the reservoir may contain 17 per cent CO2.

Petronas has recently announced a Final investment decision (FID) for what could become the largest offshore CO2 storage project globally. As part of the Kasawari development, the facility is expected to sequester more than 3 million tonnes of CO2 annually. Building on this project, Petronas aims to develop Malaysia into a regional CCS hub, potentially storing CO2 for emitters across the region. Other projects are in development in Indonesia, Timor Leste, Australia and China.

With a focus on driving down costs, many Carbon Capture innovations are in development. In several locations floating storage and injection concepts are emerging such as Stella Maris in Norway and DeepC store in Australia.

Driven by emerging emissions regulation, a number of organizations are exploring the use of Carbon Capture technologies to tackle emissions from ship engines.

Whilst new-build vessels may in future use zero-carbon fuels such as hydrogen and ammonia, the decarbonization of existing vessels will remain crucial. With CCS value chains emerging at major ports such as Rotterdam, Singapore, and Houston, access to storage is likely to be available.

The Global CCS Institute forecasts that to deliver Paris climate commitments, we need to scale up current CCS capacity more than 100 times by 2050, requiring a significant deployment. Increasing demand for offshore CO2 transport and storage infrastructure is likely to present a growth opportunity for the offshore industry in the coming years.

About the Author:

Jamie Burrows is Head of Business Development – CCUS, Energy Systems at DNV. In this role, he works closely with DNV’s clients worldwide to provide the necessary expertise and guidance to enable deployment of Carbon Capture technologies.