2023 Market Outlook

Offshore Wind: The Baltics

Offshore wind power will improve energy security for Poland and the Baltic States

In 2024, the first Polish projects will enter the construction phase, and Baltic projects will follow soon after. At stake is the reduction of energy dependence on fossil fuels.

Due to risks associated with Russian fossil fuel supplies, Poland and the Baltic countries, Lithuania, Latvia, and Estonia, have found themselves in a difficult position in terms of security of supply and stability of energy prices. The energy mix of each country differs. Poland relies most heavily on coal (almost 80% of its electricity production), Lithuania and Latvia produce energy from renewable sources and natural gas, and Estonia continues to exploit its own oil shale resources.

By Tomasz Laskowicz, Researcher at Intelatus Global Partners

In 2024, the first Polish projects will enter the construction phase, and Baltic projects will follow soon after. At stake is the reduction of energy dependence on fossil fuels.

Due to risks associated with Russian fossil fuel supplies, Poland and the Baltic countries, Lithuania, Latvia, and Estonia, have found themselves in a difficult position in terms of security of supply and stability of energy prices. The energy mix of each country differs. Poland relies most heavily on coal (almost 80% of its electricity production), Lithuania and Latvia produce energy from renewable sources and natural gas, and Estonia continues to exploit its own oil shale resources.

As a result of the war in Ukraine, Poland and the Baltic States have gained additional motivation to develop offshore wind energy even faster. Neither of these countries has built any offshore wind to date. Other countries in the Baltic Sea basin have also made very little use of the Baltic's energy potential.

Despite its relatively shallow depths and good wind conditions, only ten wind farms currently operate in the Baltic Sea, with a total capacity of 2.35 GW. The Arcadis Ost 1 wind farm recently started construction in the German section of the Baltic Sea. The largest wind farm in operation in the Baltic Sea is the 605 MW Danish Kriegers Flak project, commissioned in 2021. This situation may change in the next few years.

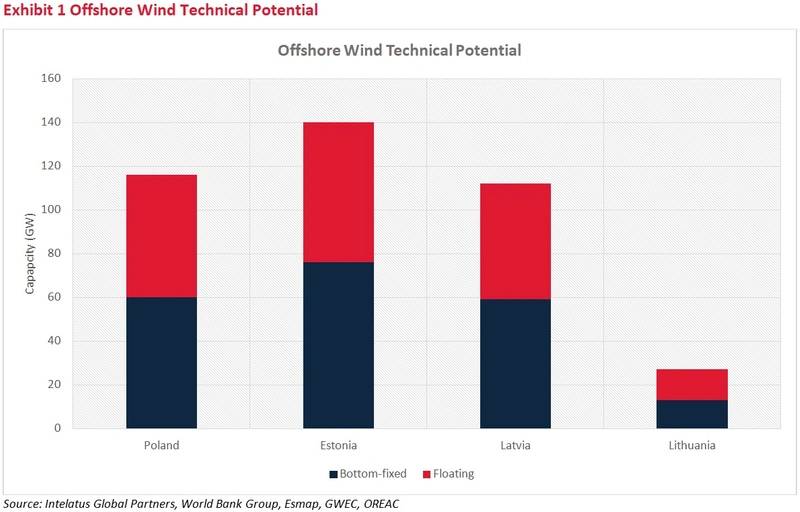

In August 2022, in Marienborg, Denmark, representatives of the EU countries of the Baltic Sea region, announced a target of installing 20 GW of offshore wind capacity by 2030. The technical potential for installing offshore wind turbines in Poland and the Baltic countries is 395 GW, of which about half can be installed as bottom-fixed turbines.

Poland is at the most advanced stage of preparation for an offshore wind project in the region and intends to put 5.9 GW of wind farms into operation by 2030.

Its footsteps are already being followed by the Baltic states, which are preparing to announce auctions. By 2035, the total value of installed wind farms in Poland and the Baltics is estimated to reach 30 GW, requiring investment of over €70 billion. As a result of construction and many years of operation, this market will offer numerous development opportunities for the local offshore sector.

Efficient permitting process key to stronger energy independence

More than 30 projects are being developed in Poland and the Baltic States. Despite the determination of governments to accelerate offshore wind development, dedicated legal solutions are just beginning to be implemented. None of the ongoing development projects have yet obtained a complete set of permits.

Possible issues that could hinder the development of offshore wind farms in the region, include areas excluded due to defense activities, shipping routes, and opposition from the tourism, fisheries, and coal-based energy sectors.

So far, Poland has enacted a special law to promote offshore wind energy development, under which projects have applied for a support scheme that awards guaranteed offtake prices.

Support was granted in 2021 to 7 projects of 5.9 GW total, which are currently at an advanced stage of obtaining environmental and construction permits and must be fully commissioned no later than 2028 in order not to lose support.

The projects in the first phase of support in Poland are being developed by joint ventures, consisting of a local entity and an international partner experienced in the offshore industry. The total CAPEX for the construction of Polish projects in the first phase of support will be as high as €16 billion.

Important players in the Polish market are state-owned companies, responsible for the largest offshore wind projects together with their international partners.

The largest identified clusters in the Polish zone are the PKN Orlen-Northland Power cluster, with a capacity of 1.2 GW; the PGE-Orsted cluster, with a target capacity of 3.4 GW; and the Polenergia-Equinor cluster, with a target capacity of 3 GW.

New projects in the Polish zone are pending proceedings for 11 sites, with decisions expected in the first half of 2023.

Lithuania has so far announced two auctions for wind farms of 700 MW each; the first will take place in the second half of 2023. The 1 GW Latvian-Estonian Elwind project is to be built by 2030, with the final location approved in October 2022.

Estonia plans to develop projects in three clusters: in the Gulf of Riga and in the vicinity of Saaremaa and Hiiumaa islands. The largest project under development in Estonia is Saare-Liivi (5.9 GW) by Utilitas Wind OÜ. Once the approvals are complete, further challenges are expected, among them a lack of existing port infrastructure and limited local and international supply chain resources.

For more information about the Intelatus Global Partners Offshore Wind Market Report for Poland and the Baltics, please visit www.intelatus.com or contact Philip Lewis at +44 203-966-2492

About the Author:

Tomasz Laskowicz is Researcher at Intelatus Global Partners and a PhD candidate at the doctoral School of Social Economic Sciences at the University of Gdansk.