Markets

The Rig Market

African Floating Rig Market Close to Sold Out

A noticeable recovery in the West African offshore floating rig market (semisubmersibles and drillships) has been slower to arrive than the other two points of the Golden Triangle – Brazil and the US Gulf of Mexico – but now appears to be well underway.

By Teresa Wilkie, Research Director, RigLogix

As of March 2023, marketed committed utilisation within the combined East and West African floater market had increased to 92%; its highest level since 93% in July 2013. Over the past year alone utilisation has risen over 10 percentage points and since March 2021 it has rocketed up by almost 30 percentage points.

This recovery has been majorly aided by a sizable decline in marketed supply. Between the height of supply in July 2014 to the trough in June 2020, the fleet shrunk by 20 semis and 19 drillships as units were cold stacked, retired or moved out of the region due to paltry demand.

Although there are still five cold stacked floaters in region, there are just two marketed units that are not currently on hire or have future work lined up, namely semis Scarabeo 5 and Aquarius.

Meanwhile, the drillship segment is now fully utilised with no availability until 3Q 2023, when Diamond Offshore’s Ocean BlackHawk finishes its current campaign with Woodside Energy offshore Senegal. There are five further drillships that could become available in 4Q 2023, but all have options that could extend them into 2024 or further if exercised.

Marketed supply in the region has been inching higher since the low of 2020. Currently sitting at 23 units, this is five rigs higher than it was in March 2022 and seven rigs higher than March 2021. This is the result of the likes of Blackford Dolphin, West Bollsta and Island Innovator, moving in from other regions such as Mexico and the North Sea for lucrative new jobs, or due to idle units in Las Palmas having been reactivated.

Higher demand is also behind the tightening market and as can be seen in Figure 1, floater demand is 47% higher than one year ago and 114% higher than the same period in 2021.

Recent Giant Discoveries Buoying Demand

Outside of the two traditionally popular areas of demand of Angola and Nigeria, new exploration and discoveries have been significant contributing factors to rig demand shown in Figure 2. Namibia, a country which until a year or two ago had limited drilling activity, will by the middle of this year have three rigs operating in parallel following large discoveries from TotalEnergies and Shell. There are also additional requirements in the market from operators to bring further rigs into the country for more wildcatting activity this year and the next. Meanwhile, Cote d’Ivoire has also seen an increase in floating rig contracting activity following Eni’s large Baleine discovery, which it plans to put into production just 18 months after the initial discovery was made.

Of the backlog secured for work in African waters from January 2022 to March 2023, 25% was for exploration and appraisal purposes and the remaining 75% for development work.

Supermajors continue to dominate in the region, with the top three largest users of deepwater rigs: TotalEnergies, Eni and Shell accounting for 74% of the secured backlog days since the beginning of 2022. These three operators are especially prevalent in Angola, along with BP/Eni joint venture Azule Energy, while they are also the main companies behind the recent Namibia and Ivory Coast discoveries. In Nigeria, contracting during the period saw 38% of contracting activity coming from smaller homegrown companies, while the remaining 62% was secured by supermajors.

Dayrates moving higher

As has been previously reported by RigLogix, dayrates across most rig types and regions have been rising rapidly with global floater dayrates on average 9% higher than this time last year and 49% higher than the same period in 2021, and the African floater market is no exception.

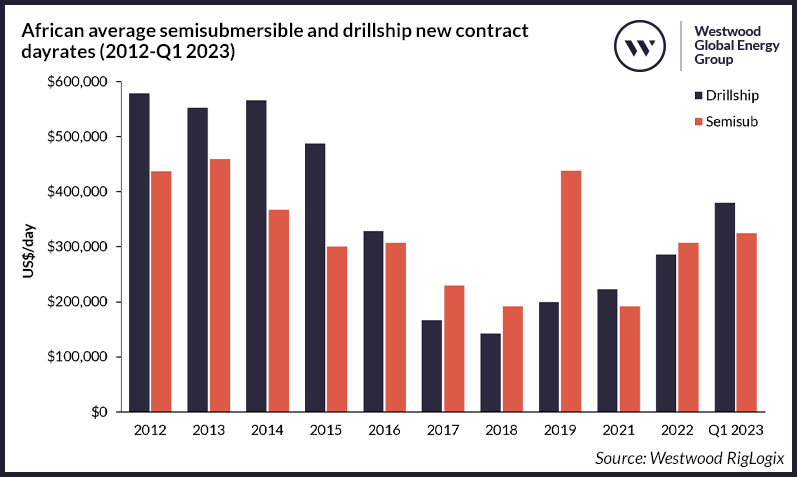

Although dayrates in the region have not recovered to the same sort of levels (circa $400,00-$550,000 per day) recorded pre-oil price crash in 2014, there has been a noticeable upward movement. Since the lowest year of demand in the region in 2018 until the first quarter of 2023, dayrates for semis have increased on average 69% ($133,000), while drillship dayrates have increased by 168% ($238,000). In the past year alone, floater dayrates overall have increased on average 24% ($69,000).

During the first quarter of 2023, African drillship dayrates have been fixed at a high of $380,000, while a semi was secured at a dayrate of $325,000. However, it should be noted that some of these contract values and dayrates include a mobilisation and/or demobilisation fee which can significantly amplify the “clean” dayrate.

What’s next for the region?

In addition to rising supply, demand, utilisation and dayrates in this region, other indications of a market recovery include increasing contract duration and options being exercised on a more regular basis. Also, further tonnage is set to enter the region this year with newbuild drillship Deep Value Driller already confirmed for Eni’s long-term campaign off Cote d’Ivoire, while another rig from the North Sea, Deepsea Mira, will be mobilised in to work off Namibia.

There are a few multi-year requirements remaining in the market from the likes of Angola’s Azule Energy, as well as several shorter-term exploration campaigns for work starting in 2023 and 2024. With the market close to sold out it is likely that more rigs will be brought in to cover this additional demand. We expect to see further newbuilds being bid into the region as well as units from areas with weaker demand, such as the North Sea. Additionally, with the improvement in dayrates, it is also likely that some drilling contractors will evaluate the possibility of reactivating cold stacked units, if the right terms can be agreed.

About the Author:

Teresa Wilkie is the Director of RigLogix within Westwood Global Energy Group, leading a team of experienced offshore rig market analysts. She has over a decade of knowledge as an analyst in the oil and gas industry brining expertise from her time at IHS-Markit (formerly ODS-Petrodata) and Esgian (formerly Bassoe Offshore).