Offshore Drilling Rigs

Operators Offering 15-Year Rig Deals as Availability Dries Up

As offshore drilling rig utilization increases and availability continues to tighten, Westwood has recorded a marked lengthening of new contract award durations as well as for new tender opportunities. On average, awarded jack-up contract durations have increased 36% compared with 2021, while drillships have increased 41% and semi-subs a whopping 117%.

By Teresa Wilkie, Director RigLogix – Westwood

As offshore drilling rig utilization increases and availability continues to tighten, Westwood has recorded a marked lengthening of new contract award durations as well as for new tender opportunities.

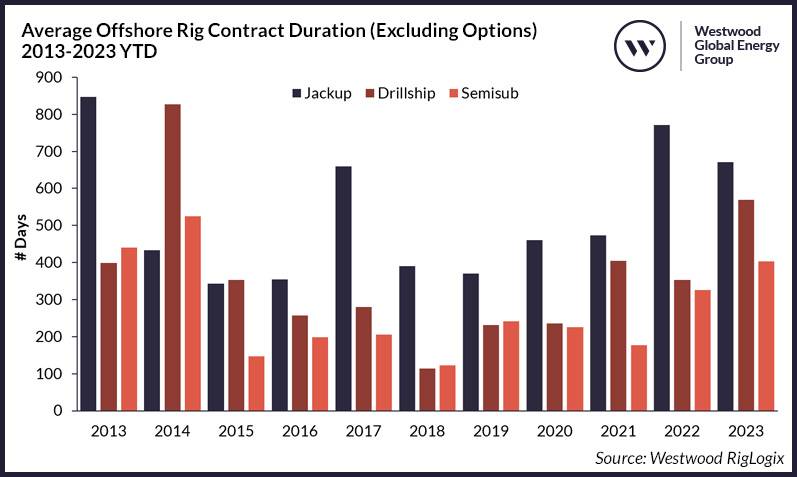

Over the last decade, new rig deal durations peaked in 2013 for jack-ups and in 2014 for floating rigs (semi-submersibles and drillships). Analysis shows that the length of such deals dwindled during the prolonged downturn and eventually reached the trough in 2018 for floaters and 2019 for jack-ups but has picked up steam again since the global rig market recovery got underway in 2021.

On average, awarded jack-up contract durations have increased 36% compared with 2021, while drillships have increased 41% and semi-subs a whopping 117%.

The areas driving these increases over the past year are quite varied according to rig type. Drillships have an average global duration of 569 days in 2023 year-to-date, driven by South America (698 days), Mexico (1,080 days), the Mediterranean (500 days), India (451 days) and West Africa (517 days).

Meanwhile, semi-subs are currently sitting at a global average contract duration of 384 days, and those areas driving demand are South America (414 days), Mexico (953 days), the North Sea (369 days), the Far East (627 days) and Australia (309 days).

Jack-up rig demand is coming from quite different areas to that of deepwater rigs, and mostly where there is a strong national oil company (NOC) presence. The average global contract duration so far this year is 661 days, and the biggest areas of demand come from the Persian Gulf (1,165 days), followed by India (840 days), the Far East (528 days), and Mexico (457 days).

Since 2022, awards with the longest contract duration have been for jack-ups in the Middle East.

Notably ADNOC Offshore awarded six deals last year, all for 15 years apiece. The same operator has since awarded a plethora of further long-term jack-up deals, five of which were fixed in June this year for 10 years apiece.

Floating rig (semi-sub and drillship) deals have so far been fixed at up to five years in duration, seen in recent fixtures for harsh environment semi-sub Deepsea Stavanger and newbuild ultra-deepwater seventh generation drillship Stena Evolution.

10-year drillship deals outstanding

Westwood believes that further lengthening in average rig deals will be seen over the coming year. Interestingly, there are already 10-year tenders out in the market for a pair of drillships required for campaigns beginning in early 2025, which is unsurprising considering marketed utilization of sixth to eighth-generation assets is already at 97%.

We also expect to see further long-term deals secured for semi-subs, especially within the sixth-generation harsh environment segment, where marketed utilization is now at 100% and there is very limited availability – free of options – until the second half of 2024.

In terms of jack-ups, where global utilization is now sitting at 92% and around 95% for premium, high-specification assets, Westwood anticipates further long-term contracting activity to continue. Currently, RigLogix shows outstanding requirements with durations of up to five years, but it is likely there will be more direct negotiations or new requirements to come that will outstrip this.

Longest lead times since 2014

Historically, contract lead times (the duration between a rig contract being awarded and the deal beginning) also begin to stretch when rig availability becomes sparse. These reached their highest in 2013, when it was common for jack-up, semi-sub, and drillship deals to be fixed at least a year in advance of a campaign beginning.

But by 2016, the average lead time dwindled to just 129 days, due to low utilization and a larger pool of readily available units to choose from – hence a lack of urgency from operators.

Compared with the 10-year average lead time, 2023 is performing almost 9% higher, but has year-to-date made no improvement on 2022’s figure, with both recording an average lead time of 237 days. However, this number is still the longest recorded since the downturn hit in 2014 (248-day lead time average).

Westwood predicts that as contract duration and utilization continue to increase, coupled with decreasing availability and dayrates heading further north, lead times will lengthen as operators become more concerned with securing the right assets for their upcoming campaigns.

About the Author:

Teresa Wilkie is the Director of RigLogix within Westwood Global Energy Group, leading a team of experienced offshore rig market analysts. She has over a decade of knowledge as an analyst in the oil and gas industry bringing expertise from her time at IHS-Markit (formerly ODS-Petrodata) and Esgian (formerly Bassoe Offshore).