Markets

Floating Wind

Preparing for Floating Wind – Leveraging the Oil & Gas Supply Chain

Examining similarities and differences between the deepwater oil & gas and the emerging floating wind segment.

By Philip Lewis, Research Director Intelatus Global Partners

There has been much excitement around the potential for the offshore wind industry to access deeper water sites through the deployment of floating wind technology.

Further, there has been much discussion around the development and deployment of disruptive technologies to leverage the opportunity of floating wind. However, in the short- to medium-term, there is insufficient time to mature early-stage concepts to the high degree of technical readiness that will satisfy classification societies, banks, insurance companies and others. This means that floating wind will need to lean heavily on the supply chains developed to support the offshore oil & gas industry.

In this article we look at some of the similarities and differences between the deepwater oil & gas segment and the emerging floating wind segment, concluding with our concern that we do not have the right number or the right type of vessels for the efficient construction of commercial scale floating wind farms.

What does deeper water mean when talking about floating wind?

The current floating wind hotspots are found in the APAC, European and North American regions.

In APAC, we look to China (100 -125 meters), South Korea (130-275 meters) and Taiwan’s pilot arrays (~100 meters). Australia and India hold significant potential, but commissioning of commercial scale floating wind projects is unlikely until around the middle of the next decade.

Europe will see floating wind deployment in the Atlantic, Baltic, Mediterranean and North Sea, with the UK (80-150 meters) and Norwegian (200-400 meters) markets likely to drive activity through this and the first half of the next decade.

In the U.S., the first commercial scale projects will be off California (500-1,300 meters). Future activity is planned off Oregon (550-1,500 meters), the Gulf of Maine (190-300 meters) and the Central Atlantic (over 2,000 meters). Canada is also investing floating wind, but this is at the early stages.

The oil & gas industry has much experience working in the water depths discussed for floating wind. The bigger challenges come in the quantities involved.

What are the numbers involved in a commercial scale floating wind farm?

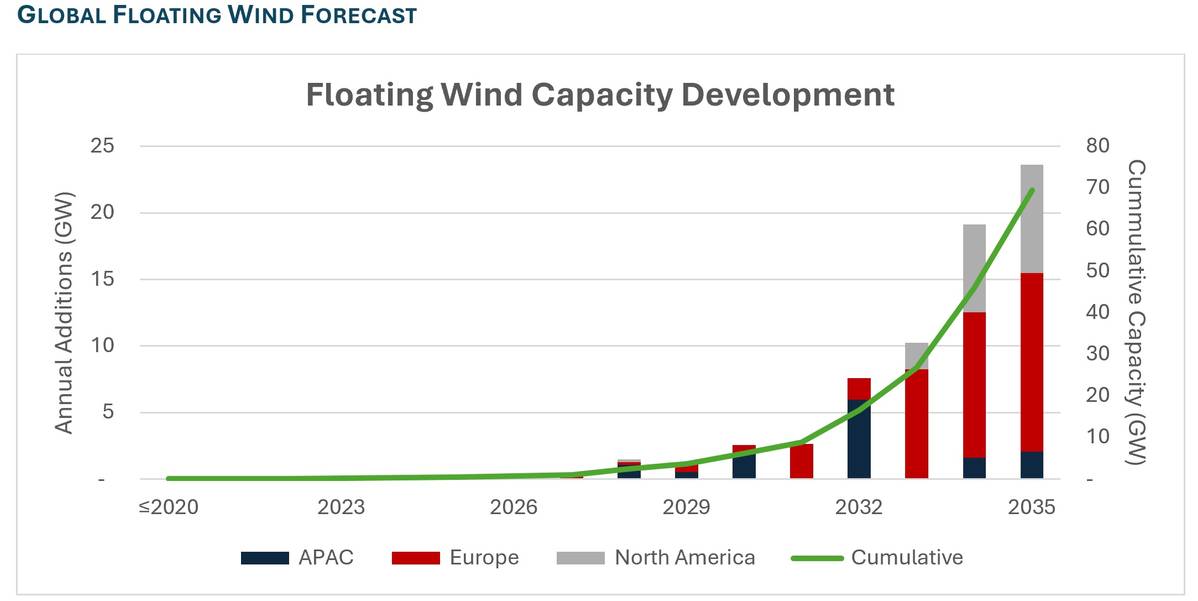

Floating wind is an emerging technology. At end of 223, total global floating offshore wind capacity was less than 250 MW out of a total offshore wind capacity of 64 GW. We forecast total installed floating wind capacity of ~6.25 GW by the end of 2030 and close to 70 GW by 2035.

To achieve the forecast, commercial scale projects will need to commence offshore mooring and array cable pre-lay operations three-to-four years before final commissioning. Currently there are concerns that the supply chain cannot cope with the quantities required.

A commercial scale floating wind farm will generally be anything larger than 500 MW and likely be ~1 GW. At a high-level, we can say that the 1 GW floating wind farm will have a similar order of magnitude capital expenditure to an FPSO. The pre-lay of moorings and array cables and the towing of the turbines will leverage skills developed in the offshore oil & gas industry.

1 GW FLOATING WIND FARM QUANTITIES

The table establishes that the global quantities of mooring lines, anchors and array cables are significant. The quantity is not the only challenge for the existing installation fleet of anchor handlers and subsea vessels, but also the physical size of the components. The size of the mooring components is also generally larger than that seen in the oil and gas industry. In fact, project planning is calling for mooring chain sizes that challenge and even exceed the capabilities of the world’s largest deepwater anchor handlers. Given that today’s fleet of large anchor handlers was not designed with floating wind in mind, it is not surprising that many are not the optimal tool for floating wind. Chain sizes can be reduced, but that results in the need for more mooring lines which accentuates the problem of vessel shortages.

What vessels do we need to build floating offshore wind farms?

Projects in planning will need large anchor handlers and subsea vessels to pre-install moorings and array cables and hook-up up the turbines, which have been towed by large anchor handlers supported by smaller anchor handlers.

Flexibility will drive floating offshore wind construction vessel utilization. Vessels will need to accommodate a variety of anchor types, chain, fiber rope and steel wire mooring lines, and tensioning operations.

Apart from one large vessel suitable to support floating wind projects that was delivered in China last year, there has basically been no large anchor handling vessel ordering since 2014, including the last big vessels delivered in 2018-20. This asset class is seeing increasing demand from oil & gas work and was generally not built with floating wind in mind and so most vessels can be classed as suboptimal for floating wind.

Subsea vessels are being used to support oil & gas and bottom-fixed offshore wind vessels. Utilization in the segment is high and there has not been some new building activity, with orders placed for at least three new subsea vessels with 250 tonnes AHC cranes, the minimum required for floating wind projects.

As with bottom-fixed wind, floating wind projects will be supported by walk-to-work vessels (CSOVs or MPSVs and PSVs with active heave compensated gangways), CTVs and other support OSVs.

So, does this signal a potential spike in new building?

New building of vessels suited to efficient floating wind construction is needed.

Increasing utilization and competition for key vessels is translating to higher rates and, at least for subsea vessels, ordering.

However, barriers to vessel FID still exist through technical, regulatory, and financial uncertainties. Until these barriers are cleared, vessel ordering will remain low and impact on floating wind projects.

In closing, we wish to extend the debate from hardware issues (vessels) and talk about the software (people). Attracting and retaining the next generation of talent and building sufficient technical competence in a timely manner is a key industry challenge and one that needs every bit as much attention as the vessel numbers and capabilities.

About the Author

Philip Lewis is Director Research at Intelatus Global Partners. He has extensive market analysis and strategic planning experience in the global energy, maritime and offshore oil and gas sectors.