Markets

Rigs

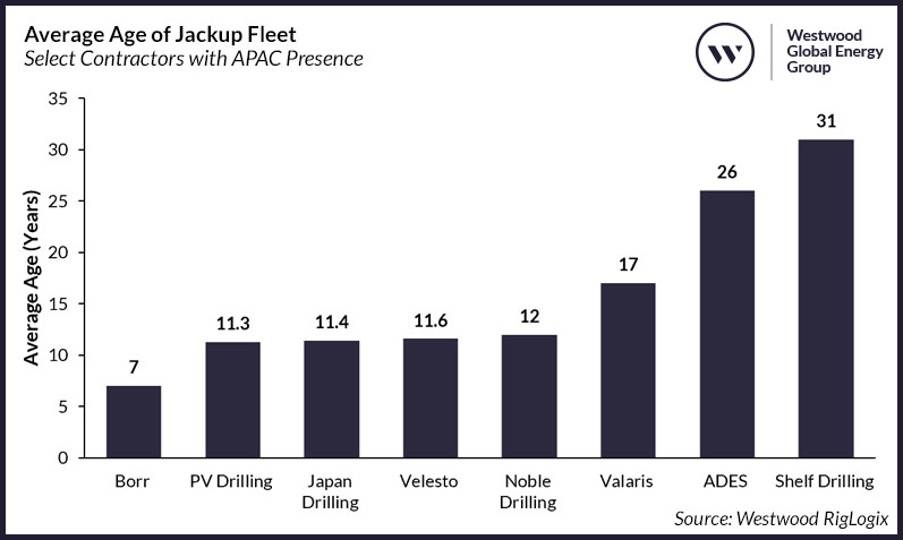

Impending Shortage of Jackups within Ageing Asia Pacific Fleet

While utilization for marketed jackup rigs is at a healthy 100% in the Asia Pacific (APAC) region, it is an ageing fleet that will ultimately be unable to fulfil operator age requirements.

By Paul Ezekiel, Senior Rig Expert, Westwood Global Energy Group

Westwood’s RigLogix records 39 marketed jackups in APAC. This number excludes two units under construction in Singapore, five National Oil Company (NOC) units operating in Vietnam, and two cold-stacked units in Labuan. The current age breakdown shows 16 units in the 1-10-year age bracket, 18 units aged 11-20 years, and three units aged 21-41 years. The two units operating in Australia are 18.6 and 25.8 years old respectively.

Operators generally stipulate rigs to be no more than 15 years old as part of their technical requirements. By 2030, only 20 units or less will be available that meet these criteria. This includes an additional Borr Drilling unit due for delivery at the end of this year, with the assumption that it does not leave the area. Expanding outside of APAC, the average age of the global marketed jackup fleet is 20 years.

An interesting observation is that while ageing jackups are mobilising into the region, newer units have ended up in Saudi Arabia and continue to leave for other regions. Since the beginning of the year, Shelf Drilling Perseverance, Valaris 247, Emerald Driller, Topaz Driller, Admarine 502, COSL Seeker and Baltic have entered the APAC region. The youngest of these “new entrants” is 11.4 years and the oldest is 40.7 years. At the end of the year the newbuild Vali will be leaving the area. It is worth noting that APAC includes Australia, but excludes China, Japan and Korea. The latter two have a transient fleet of rigs that operate there when needed, then generally demobilise back to Southeast Asia.

Adapting to Prevent a Jack-up Shortage

Here are four possible solutions to the impending problem of a shortage of jackups. Firstly, operators could amend the age requirements, to ease supply in the near term. Inspections would need to be more regular, and a more stringent maintenance regime may need to be put in place to keep the rigs in good operational conditions.

Secondly, operators taking equity in the rigs could help reduce contractor costs, and in turn pay lower dayrates since not subject to market fluctuations and availability. The operator-contractor relationship must become more of a partnership as opposed to the current customer/service provider. One key factor is the sharing of responsibilities in a manner befitting of the term “partnership”.

The third possible solution is to build new units. At this point in time, newbuild costs still appear to be prohibitive. Contractors seem to concur that current dayrates cannot support the cost. In its most recent presentation, Borr Drilling said: “Newbuild economics would require dayrates in excess of US$200,000 for the usable asset life of 25 years”. Indications from shipyards are that a new jackup could cost in the US$300 million range with a delivery runway of about 36 months.

There is much less appetite to invest in the oil and gas industry these days. Obtaining financing for such projects is a challenge as banks or financial institutions fear of reprisals from environmental groups or just do not want to be involved with oil and gas. Following the downturn of 2014 and the current focus on clean energies, shipyards have turned their efforts on other types of projects such as FPSO, FLNG and Wind Installation Vessel builds and therefore do not have the immediate capacity. Perhaps a measured approach of building one or two units, with some financing from operators (especially the big NOCs and supermajors) could offer long-term contracts to support such investments.

Finally, rigs from the Middle East could return to the APAC region. There are currently 24 jackups in Saudi Arabia less than 10 years of age. Current rates in APAC are more attractive than in the Middle East, however recent bidding trends within Southeast Asia show an easing of rates, brought on by the excess supply from the Saudi Aramco contract suspensions and the uncertainties within Malaysa (vis-à-vis) PETRONAS and PETROS negotiations.

Unless action is taken, operators will most likely find themselves short of premium jackups for drilling operations in the Asia Pacific region. There may need to be a shift from traditional contracting methods and streamlining to reduce the current cumbersome tendering processes. Waiting times for regulatory approvals could also be decreased, making the region more attractive to contractors.

About the Author

Paul Ezekiel is Senior Rig Expert at Westwood Global Energy Group. You can reach Paul at pezekiel@westwoodenergy.com