Markets

OSVs

OSV 2Q Recap: Entering the Capital Distribution Phase

The OSV sector has concluded its second quarter earnings season, marking another quarter with strong profitability and favorable market conditions.

Magnus Øye Andersen, Equity Research at Fearnley Securities

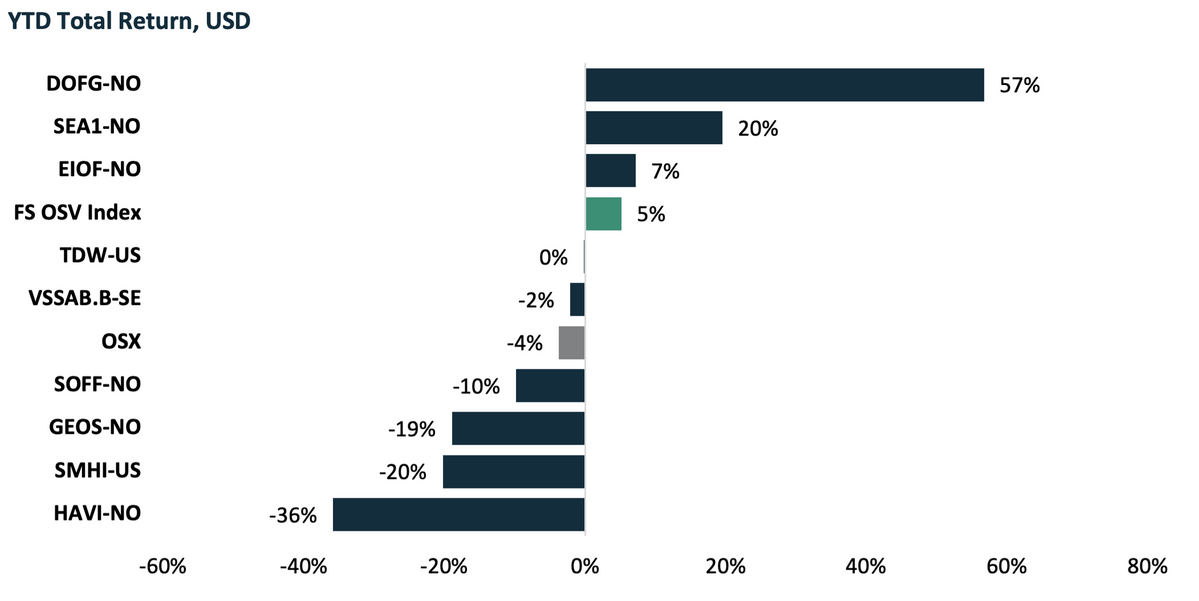

However, negative oil market sentiment, with the Brent price down by 19% since the start of July, has impacted the overall oil services market with the wider PHLX Oil Service Index trading down 4% year-to-date. The OSV sector has returned 5% year-to-date at the time of writing, led by DOF’s 57% performance.

Dayrates Continued to Rise

Tidewater was the first out of the blocks this earnings season, posting results in-line with market expectations. The company increased its average achieved dayrate by USD 1,600 to $21,100, which marks the 2nd largest quarterly increase since the market recovery started in early 2022. Tidewater contracted at an average rate of $28,800 last quarter, which was down from $30,600 in the first quarter as the contracting was skewed towards lower spec vessels. Looking at the underlying figures, however, the contracted rates for large PSVs and AHTSs increased by 8% and 13% respectively.

Dividends on the Menu

Sea1 Offshore followed up with an important milestone - the first sizable dividend distribution of the current cycle - as Sea1 Offshore announced a dividend distribution of NOK 5 per share. This equaled a 16% yield at time of announcement. We estimate that Sea1 will be able to maintain the dividend level for 2025, increasing to NOK 6 per share in 2026. This equals a yield of 17% and 20%, respectively.

DOF followed up soon thereafter, announcing to commence quarterly distributions in the second quarter of 2025. The company expects to distribute $0.3 per share, which equals 14% annualized dividend yield. DOF will review the size of dividend on a quarterly basis and given a continued strong market the company sees the potential to increase the distributions from 2026 and onwards. Moreover, DOF hiked the lower end of its 2024 EBITDA guidance range, now guiding $500 – 520 million. This is up from $490 – 520 million from the first quarter update and $470 – 520 million from the fourth quarter last year.

Moreover, DOFG announced during the summer that the company is acquiring Maersk Supply Services for circa $1.1 billion. The transaction will be paid with $577 million in cash and 59 million new shares in DOF. Following the acquisition, DOF owns 65 vessels with an average fleet age of 10.7 years. The transaction was set at 0.8x EV/GAV, while DOF has been trading above 1x in the months prior to the transaction. Thus, impressive work from DOF in acquiring quality assets at an attractive price.

Opportunities Arise in a Volatile Oil Market

Since the start of July, the sector has been trading down 24% as the Brent spot priced has turned from $87 per barrel to $78, and even trading as low as $70 per barrel in September. With project break even prices sitting mostly well below $50 per barrel, we argue that an oil price environment above $60 per barrel should not impact project sanctioning and thus vessel demand. With the Brent price in or near the 60’s however, the risk is starting to being gradually factored in by the market even though it has limited effect on earnings. This has created some very attractive opportunities with sliding share prices, as long as the oil price is not turning for worse.

Trading at 3.5x and 2.0x 2025 and 2026 EV/EBITDA we argue that the sector holds an attractive risk/reward. Moreover, on our estimates we have Tidewater, DOF, and SEA1 trading at 0.91x, 0.81x, and 0.76x year-end 2024 P/NAV, respectively. Tidewater’s pricing premium in terms of earnings multiples and steel values has more or less vanished over the last few weeks, making for an attractive entry opportunity in the large-cap player. We expect Tidewater earnings to increase substantially going forward as the company is churning through its legacy contracts. Current average backlog duration sits at 1.5 years, in that time frame we expect the average dayrate to converge with the current reported contracted rate.

All-in-all we are firmly keeping our Buy recommendation on the sector, with current dayrate levels implying high profitability and enabling solid dividend potential. However, while oil market volatility has led to increased risk for OSV demand, we currently see this as a buying opportunity as pricing on earnings multiples and vessel values has become attractive. With dividends on the table, we are currently set for a stage in the cycle where capital is flowing back to shareholders, a welcoming sight to a situation which was quite the opposite just some years ago.

About the Author

Magnus Øye Andersen is an equity research analyst at Fearnley Securities. He covers the energy services space, including offshore supply, offshore wind vessels and seismic, listed in Oslo, New York, and Paris.