Markets

Floating Offshore Wind

Floating Wind Vessel Supply & Demand through 2035

By Philip Lewis, Research Direct, Intelatus Global Partners

Floating wind is an emerging technology, currently being tested in small scale demonstration and pilot projects. Global commissioned floating wind capacity is forecast to amount to ~6 GW by 2030 and ~50 GW by 2035. A sharp increase in activity is expected in the period 2031-2035. Market growth will initially be led by the South Korean market, but the European market, led by the UK and France, is forecast to dominate in the next decade as North America and other East Asia Pacific markets join the fray. To reach ~50 GW of installed capacity by 2035, capital investment of around a quarter of a trillion dollars is required.

Although there are many different solutions to building a floating wind farm (different floater, anchor and mooring line types), the nature of floating wind projects, both in numbers of systems to install and their physical size, drives demand for the largest and most highly specified anchor handlers and subsea vessels.

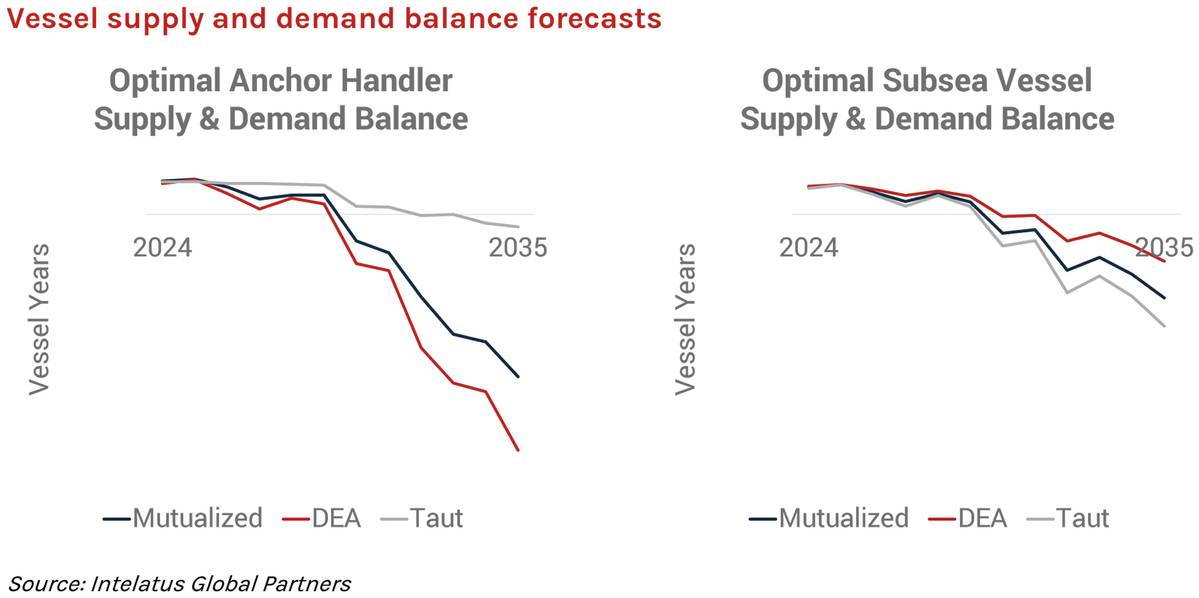

Significant vessel shortages are forecast through the middle of the next decade.

This vessel shortage will drive shortages of qualified and experienced seafarers, which appear from ~2030. Shortages will be in all senior bridge, deck and engine room positions. To demonstrate the trend, the chart presents a forecast of additional Senior DPOs and DPOs onboard (i.e. excluding back-to-back crew).

These are the findings of a comprehensive new floating wind installation vessel market report published by Intelatus Global Partners. The report examines a range of technical drivers, summarizes the findings of the latest research, presents a deep dive into each of the major floating wind markets and translates the activity forecast into a vessel supply and demand balance forecast.

THE MARKET IS GROWING – BUT POSSIBLY NOT AS QUICKLY AS SOME BELIEVE

As we have mentioned previously, floating wind is an emerging technology. Concepts are still be demonstrated in single turbine and small pilot arrays. The first commercial scale arrays (±500 MW) with offshore construction activity within this decade are being planned for such markets as South Korea and the UK.

From around ~305 MW installed at the end of 2024 to ~6 GW (2030) and ~48 GW (2035). Market growth anchored by Europe in the first half of the next decade.

Through this decade, we anticipate that South Korea will be the largest floating market, but the first half of the next decade is likely to be dominated by activity in Europe, with the UK, France, Italy, Portugal forecast to be the most active (but not only) floating wind markets. The U.S. enters the floating wind stage during the forecast period with both pilot and commercial scale developments on the West Coast and pilot arrays on the East Coast.

HOW DO YOU BUILD A FLOATING WIND FARM?

At a high level, building a floating wind farm can seem to be a simple exercise, as shown in the graphic.

However, the uncertainty over what we will be installed, volumes of components to be handled and their sheer physical size present many challenges to floating wind developers. Let’s look at the differences that sets the building of a floating wind project apart from the established bottom-fixed segment to understand these challenges of technical uncertainty, volumes and sizes of components.

-

It starts with the floater, for which there are more than 100 concepts being developed globally that are broadly grouped in semi-submersibles, barges, spars and TLPs. These concepts can be built from steel (rolled stiffened plate, flat panel construction and heavy-walled tubular, etc.) or concrete (slip formed, pre-cast, with reinforcement, with post tensioning tendons, etc.). Some concepts feature steel plate construction familiar to shipbuilders while others rely on large diameter steel pipes produced at offshore wind monopile and tower manufacturing plants. Steel concepts can be manufactured in sub-assemblies and shipped to assembly yards or can be shipped as complete units from construction yards on heavy lift vessels. Concrete concepts are generally more suited to local manufacture and assembly. Depending on the concept selected, each floater for current generation turbines could weigh from below 5,000 tonnes to 20,0000 tonnes. A commercial scale project will require ~30-35 of these floaters per year to meet installation requirements of one full installation spread.

-

Turbine installation is generally expected to take place at the assembly port. Next generation turbines with larger diameters drive the hub height where a crane needs to lift weights of 750-1,050 tonnes to over 180 meters assuming the currently available large turbines. A key variable to monitor is the development by Chinese developers of turbines as large as 25 MW with rotor diameters of ~300-310 meters. Suitable crane supply is limited today and with potential increases in rotor diameters will become even more limited. Once assembled, several turbines will likely be wet stored before being towed offshore for hook-up. Due to installation season weather windows, this period could last 4-6 months. The implication is that a sufficient supply of suitable large, sheltered harbor facilities is required.

-

A station keeping system is required for the floating turbines. There are many different solutions available depending on the specific site conditions and floater design, but suction anchors, drag embedment anchors and driven piles are likely to feature in most projects in the short- to mid-term. Again, depending on a number of variables, anchors can be shared by mooring lines or each mooring line can feature an anchor. The base case is for each floater to generally require three mooring lines, either in a 3x1 (3 lines per floater) configuration, a 3x2 layout or even 3x3. The uncertainty over the technical solutions drives us to develop our three base scenarios (mutualized suction anchors, drag embedment anchors and taut mooring with suction anchors) to present an order of magnitude of the volumes of components, the demand for vessels and to highlight the impacts and major differences in the various technical choices. It is likely, at least in the short-to-mid-term, that mooring systems will feature sections of large chain (~130-1800mm) and sections of large fiber rope (±300mm).

-

Complete assemblies will be towed offshore by a spread of tugs including lead, support, and security tugs and then hooked up to the pre-laid moorings. Tensioning of the mooring system will generally be required, more often than not from the vessel rather than the floater. It should be noted that the impact of larger turbines referenced earlier will likely be larger floaters and more robust (larger in number and/or size) moorings, which of course can increase the technical requirements for towing and hook-up vessels.

-

Array cables can be pre-laid and wet-stored with the moorings or installed when the floaters are hooked-up. A key difference in floating wind array cable systems to those found on bottom-fixed projects is that the subsea cables are flexible or dynamic and are suited to deployment by vertical lay systems.

-

Substations can be bottom-fixed, floating or even subsea, depending on the specific project site characteristics. Export cable laying is for the most part the same as seen in bottom fixed wind farms.

TURNING THE FORECAST INTO VESSEL DEMAND

We have prepared a bottom-up forecast for activity through 2035 and have developed demand models for three scenarios:

-

Mutualized catenary mooring lines (very large diameter chain and fiber rope) connected to suction anchors.

-

Drag embedment anchors, two per floater mooring connection, connected to individual catenary mooring lines (large diameter steel chain, smaller than that of the mutualized and taut mooring case, and a fiber rope mid-section).

-

A taut mooring system with a smaller footprint, with predominantly fiber rope mooring lines and connected to induvial suction anchors.

The mooring scenarios deliver significantly different results of anchor demand (~10,000-30,0000 anchors) and mooring lines (~17,000-35,000). We expect to see all three systems used, although the catenary systems are likely to be preferred in the short-to-mid-term. More than 14 million meters of array cables are also forecast to be installed in the period.

The characteristics of the components drive the need for large anchor handlers and subsea vessels. In our report, the detailed technical analysis takes the reader through the drivers to understand the constraints in terms of capacity, capabilities and efficiencies of vessels and why the large vessels will be required.

The simple conclusion is that there is insufficient technically capable vessel supply to meet forecast demand in the next decade.

ARE BIG, EXPENSIVE FLOATING WIND SPECIFIC VESSELS THE ANSWER?

The quick answer is “no”.

Unless charters agree long-term vessel utilization, there will be likely be several months every year where a floating wind specific vessel will be underutilized. Long-term charters commitments will be needed to justify investment in high-cost assets. These conditions do not currently exist.

There is a greater argument for large subsea vessel building, due to the flexibility of the assets to work in both oil & gas and offshore wind (bottom-fixed and floating) space. But the high-specification anchor handlers required by floating wind projects are a more difficult investment case. What most floating wind projects will require is generally technically very different from most oil & gas projects. As a result, a typical large oil & gas anchor handler will lack one or more of the key technical features to be an efficient tool for commercial floating wind projects.

The Intelatus Global Partners Floating Wind Installation Vessel Market Forecast is available for purchase. The comprehensive report addresses floating wind market and vessel technical drivers, presents a detailed regional and country level analysis of the global floating wind landscape, presents an activity forecast through 2035 and translates the forecast into component quantities and detailed vessel demand for construction and major component exchange vessels (anchor handlers, subsea vessels and walk-to-work vessels).

For more information, please contact info@intelatus.com or philiplewis@intelatus.com