Decarbonization

Carbon Capture & Storage

CCS Delivers Surprise and Uncertainty

There’s two problems that demonstrate the immaturity of CCS: the physics for predicting CO2 behavior isn’t perfect, neither are the 4D seismic strategies required to make up for it.

By Wendy Laursen

3D view of Sleipnir data

Image courtesy TGSPhysicists at Los Alamos National Laboratory recently pointed out that current physical models of sequestered CO2 don’t properly account for the elasticity of a rock when it is saturated by a fluid. They have developed a new model they hope will make monitoring of CCS sites more reliable.

Physics models such as the Biot-Gassmann equation, and the newer model from Los Alamos, along with others such as Darcy’s Law, are used to simulate CO2 behavior. The aim is to avoid “subsurface surprises” – finding sequestered CO2 in unexpected places.

The CCS industry relies on geological and flow simulation models to predict CO2 plume development over decades. The surprise usually turns out to be significant permeability features, such as invisible faults or barriers, that are not detected in seismic surveys and therefore cannot be accurately included in simulations.

Using an oil and gas seismic survey system for CCS monitoring is like using a military tank for daily commuting. - Frank Chen, Senior Solutions Architect, Ovation Data

Using an oil and gas seismic survey system for CCS monitoring is like using a military tank for daily commuting. - Frank Chen, Senior Solutions Architect, Ovation Data

“This isn't to say that geologists and reservoir engineers haven't done their part well,” says Frank Chen, Senior Solutions Architect at Ovation Data. “The challenge lies in the fact that the input models, heavily controlled by only a few wells, often need more details of geological heterogeneity in areas without well control.”

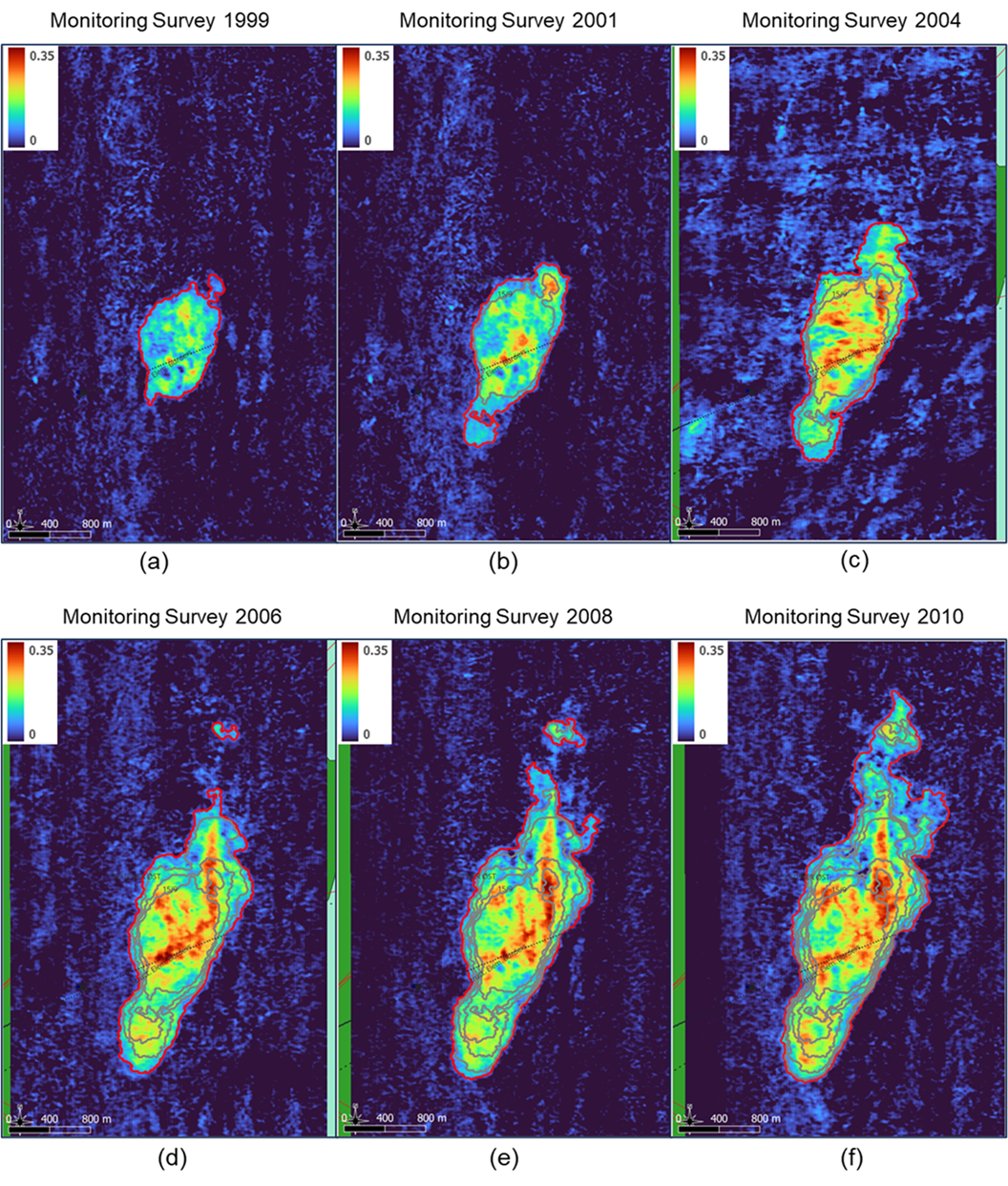

4D seismic, which compares time-lapse differences in seismic surveys to capture snapshots of the CO2 plume front over time, is perhaps the only physical measurement that can 'directly measure' the CO2 plume front laterally, especially far from the injection well location, says Chen.

“4D seismic offers detailed mapping of the CO2 plume front. Moreover, it is an invaluable communication tool that bridges understanding among operators, regulators and the general public, especially when a vast amount of taxpayer money is at stake in a CCS project.”

There’s a lot of interest in optimizing costs, and a lot of scope to do so. “Most offshore CCS project injection formations are shallow, typically less than 1,000 meters deep. In contrast, oil and gas targets are much deeper, often requiring good imaging at depths of up to 5,000 meters. Using an oil and gas seismic survey system for CCS monitoring is like using a military tank for daily commuting,” says Chen.

Equipment mobilization and deployment costs constitute a significant portion of seismic acquisition. Gregor Meikle, Technical Director – Seismic at Tetra Tech RPS Energy Limited, helps design acquisition strategies. These strategies consider the usefulness of existing datasets and practical considerations such as streamer positioning, weather conditions and SIMOPS, says Meikle. New data will be compared back to baseline data, so if extra lines were required then, the company’s acquisition planning involves optimizing line planning and quality control next time.

Image courtesy TGSUnderstanding of the overburden and the geology beyond the storage unit plays a critical role in the site validation. This requires large, yet detailed, subsurface models. - Bård Stenberg, VP IR & Business Intelligence, TGS

Image courtesy TGSUnderstanding of the overburden and the geology beyond the storage unit plays a critical role in the site validation. This requires large, yet detailed, subsurface models. - Bård Stenberg, VP IR & Business Intelligence, TGS

Legacy data can be useful even though a major part of the energy recorded by sensors has historically been treated as noise. Better physics, newer algorithms and scalable compute resources allow geophysicists to extract more accurate and complete information of the subsurface, for example using multiple reflections and waveforms other than reflections, says Bård Stenberg, VP IR & Business Intelligence at TGS.

A suitable CO2 reservoir has a solid cap rock with an impermeable low porosity layer to prevent the CO2 from migrating vertically. Additionally, a good spread of the CO2 plume inside the reservoir is needed to ensure efficient storage. “Understanding of the overburden and the geology beyond the storage unit plays a critical role in site validation. This requires large, yet detailed, subsurface models,” says Stenberg.

It also requires processing power. Seisnetics has adapted concepts from genetics for its AI-driven tools for detecting valuable information from big and complex seismic datasets. Its algorithms split seismic traces into small waveforms and then try to find similarities elsewhere and group them into families. The solutions are data driven: no models, simplifying assumptions, data training or human guidance is required. This optimizes processing time and produces unbiased information from 3D seismic volumes.

Image courtesy ShearwaterToday procurement processes for seismic are inflexible and inefficient and are a contributing factor to the end cost of seismic. - Tanya Herwanger, SVP of Strategy and New Markets, Shearwater

Image courtesy ShearwaterToday procurement processes for seismic are inflexible and inefficient and are a contributing factor to the end cost of seismic. - Tanya Herwanger, SVP of Strategy and New Markets, Shearwater

Shearwater Geoservices offers its proprietary processing software Reveal and is currently building new technology key to CCS within the platform, including spectral-element-modelling-based full-waveform inversion (SEM-FWI). SEM-FWI models the near-surface more accurately, as SEM moves away from forcing its modelling to fit into a regular grid of cuboids and instead allows the modeling to honor the geology, adapting when the geology changes rapidly.

Shearwater is partnering this with the use of NVIDIA's GH200 Grace Hopper superchip which is specifically designed to handle giant-scale AI applications by providing faster memory and massive bandwidth. Shearwater is investing significantly in AI research, and Senior Vice President of Strategy and New Markets, Tanya Herwanger, sees the company’s new AI-based uncertainty qualification as game changing for CCS. “Driven by pressure to reduce costs, we expect companies to design 4D monitors that are sparser than the baseline. Having uncertainty estimates associated with models coming from sparser, more resource-constrained data will be paramount.”

Monitoring strategies will vary from site to site and potentially also from country to country, depending on the regulations. 4D seismic will no doubt play a role, says Herwanger, but this may well be part of a broader plan that includes some kind of detection or trigger system that alerts the site operator to take a closer look. “Potential hybrid solutions feature in many of the discussions. These involve configuring ocean bottom nodes, fiber optic cables and streamers. Aspects such as long battery life which extends the time between deployment and recovery will open new possibilities. Shearwater’s Pearl node has industry leading battery life of 150 days and extending that is certainly something we are looking at.”

Herwanger expects business models to evolve to address subsurface data needs in hub environments with multiple storage sites and operators close together. This could involve operators working together. “Today procurement processes for seismic are inflexible and inefficient and are a contributing factor to the end cost of seismic. In traditional oil and gas, operators seem unable or unwilling to update their procurement practices to access seismic services in a smarter, more efficient manner. Will they manage to do so for CCS?”