Markets

SOV/CSOV Segment

SOV/CSOV Through 2030:

Oversupply and Market Volatility

By Philip Lewis, Research Director Intelatus Global Partners

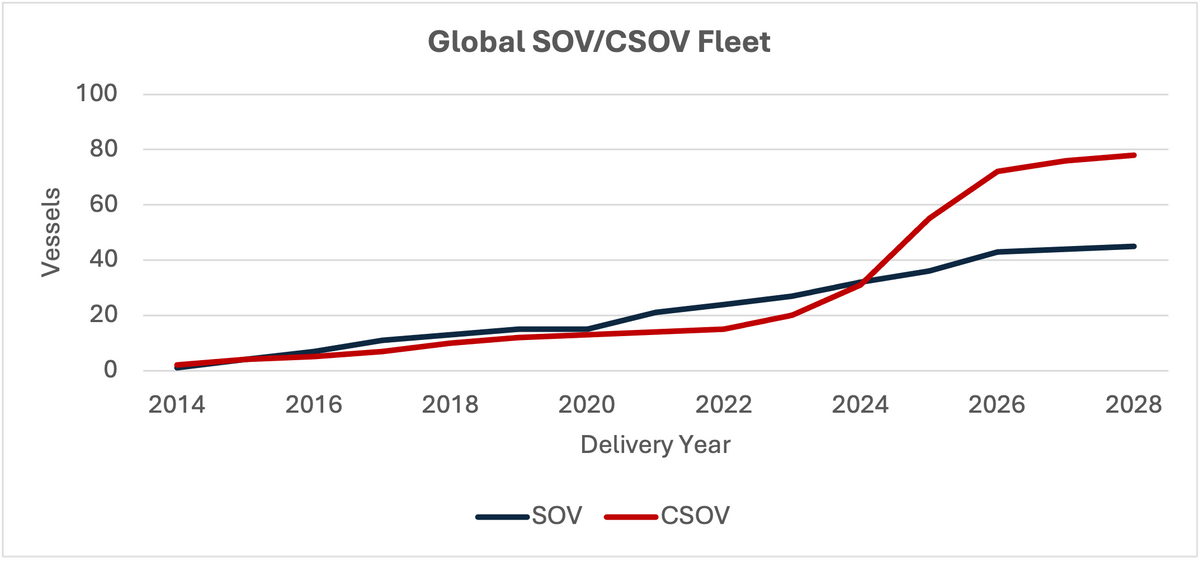

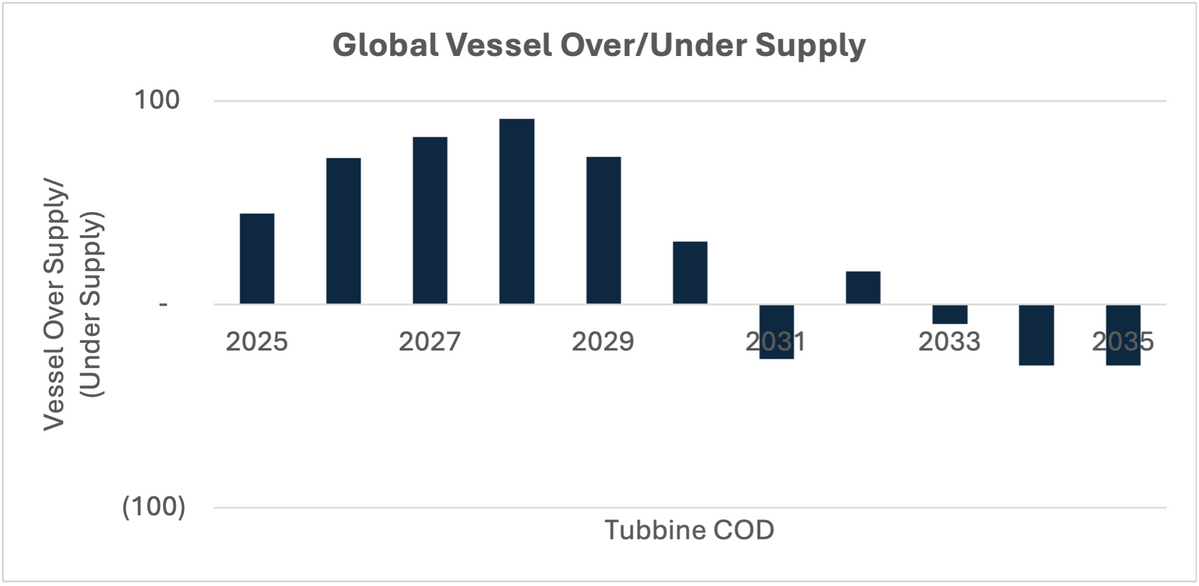

There has been much interest in the Service Operation Vessel (SOV) and Commissioning Service Operation Vessel (CSOV) segment in recent years. As a consequence of this interest, the combined SOV and CSOV fleet will almost double in size from the end of 2024 to 2028. The rapid expansion of the offshore wind fleet is creating both opportunities and risks. While the demand for offshore wind support vessels is growing, the near-term oversupply will put financial pressure on vessel owners and could trigger S&P (vessel sales & purchase) and M&A (company mergers and acquisitions) opportunities. However, looking beyond 2030, new vessel orders will be required to sustain the next phase of offshore wind development.

A new 110-page report from Intelatus Global Partners presents an in-depth review of the SOV and CSOV market analyzes the reasons for an imminent oversupply of vessels that could disrupt the offshore wind sector between 2025 and 2030.

Defining the Segment

SOVs have traditionally been associated with long-term wind farm operations and maintenance support charters of 10 years or more, and increasingly mid-term (2-10 years) deployment. The guaranteed utilization results in vessels on charter for comparatively low day rates, often yielding single digit IRRs.

CSOVs have traditionally been chartered for offshore wind construction and commissioning campaigns, lasting two years or less. Day rates for these vessels respond quickly to vessel supply and demand balances. Although these rates have been trending up, the forecast vessel oversupply in 2025-2035 is expected to impact utilization and day rates. Some CSOVs have been chartered to satisfy long-term requirements, but at SOV rates. While some of the surplus vessels are likely to find employment in the oil & gas sector, this shift will not be sufficient to offset the excess supply.

Our forecast covers two tiers of vessels:

-

Tier 1 vessels are purpose built offshore wind DP2 vessels with motion compensated gangways a 3D cranes. All new building vessels are currently Tier 1 vessels

-

Tier 2 vessels are generally converted oil & gas MPSVs and PSVs with a permanently installed walk-to-work system and crane. At present, there is only one Tier 2 conversion ongoing, and this is a specific case for U.S. market.

Growing Supply Side

The global Tier 1 and Tier 2 fleet is expected to grow from over 60 vessels in 2024 to 115 in 2026, and to at least 123 vessels by 2028.

Our research shows that forecasted vessel demand will not keep pace with this rapid expansion, leading to an oversupplied market for much of this decade. Whilst demand is global, Europe is by far the largest market for SOVs and CSOVs.

Despite the current oversupply trend, new vessel orders will likely be needed post-2031 to meet longer-term offshore wind demand.

Crewing the Vessels

A concern for vessel owners is the ability to attract, develop and retain sufficient numbers of competent and qualified crew.

In the SOV and CSOV, there are two major challenges to address:

-

Recruiting an additional ~1,500 senior crew positions and an additional ~1,725 other positions to crew all the confirm new buildings arriving on the market in 2025-2028.

-

Addressing increasing local content barriers and costs for crewing vessels in the core SOV/CSOV market of the UK, Europe, Taiwan, Korea and the USA.

What does this all mean for the financial position of owners

We have undertaken an analysis of the financial reports of large SOV/CSOV owners accounting for close to half of the delivered fleet.

Many owners already face cash flow constraints, balance sheet pressure, and bottom-line challenges. The forthcoming forecast vessel oversupply is only expected to make conditions more challenging. One consequence is that vessel S&P and company M&A activity will become a key theme in the coming years.

Report Availability

The full report is now available at https://intelatus.com/Business/sovforecast

About the Author

Philip Lewis is Director Research at Intelatus Global Partners. He has extensive market analysis and strategic planning experience in the global energy, maritime and offshore oil and gas sectors.