FPSOs

Fleet Development

FPSO Fleet Fills Out

The global FPSO fleet is trending towards more, and large capacity, newbuilds.

By Wendy Laursen

The Liza Unity FPSO is designed to produce approximately 220,000 barrels of oil per day, to have associated gas treatment capacity of 400 million cubic feet per day and water injection capacity of 250,000 barrels per day.

Photo courtesy Lim WeixiangThe FPSO market in 2025 is expected to remain stable, with 10 to 12 offshore production projects reaching final investment decisions (FIDs)—a continuation of 2024 trends. Brazil remains a focal point, with Petrobras leading significant developments, including the Petrobras 86 project and SEAP 1 and SEAP 2 FPSOs. Shell's Gato do Mato project is also anticipated to move forward early in the year.

"The year is front-loaded with Brazil's activity," says Matt Tremblay, Vice President, Global Offshore at ABS. "We expect around four to six FIDs in both the first and second halves of 2025, with the majority leaning toward new construction. However, some conversions will still play a role."

Traditionally, FPSO conversions—modifying existing tanker hulls for offshore production—offered a cost-effective and faster alternative to newbuilds. However, the industry has seen an increasing tilt toward new construction, with 80% of projects in 2024 being newly built.

This trend is fueled by major players such as Exxon and Petrobras, who are commissioning high-capacity FPSOs, exceeding 200,000 barrels per day. Tremblay notes, "Conversions can't accommodate FPSOs of this scale, as they're larger than even the biggest ultra-large crude carriers (ULCCs). And with limited shipyards capable of building them, costs are naturally higher."

Image courtesy SBM OffshoreThese projects are not pushed off the quayside at the earliest opportunity. We want to make sure that they’re fully commissioned and ready for operation. - Alexander Glenn, Chief Operating Officer of SBM Offshore

Image courtesy SBM OffshoreThese projects are not pushed off the quayside at the earliest opportunity. We want to make sure that they’re fully commissioned and ready for operation. - Alexander Glenn, Chief Operating Officer of SBM Offshore

The global supply chain remains a critical concern for FPSO construction. Tremblay emphasizes that while equipment delivery delays have stabilized, prices continue to rise.

"The cost of FPSOs has soared," he said. "The P-78 FPSO was contracted at $2.5 billion, but just a few years later, P-84 and P-85 are each valued at $4.1 billion."

A key factor behind this cost escalation is vendor strategy. Tremblay compares FPSO equipment manufacturers to offshore drillers: "After years of financial losses, they're holding off on expanding capacity and instead capitalizing on high demand to maximize profitability. ABS has surveyors embedded in these shops, and we see firsthand that capacity isn’t being added."

Another part of the supply chain equation is the shipyard.

With only a handful of shipyards capable of building FPSOs, the market remains constrained, and China dominates, with four to five active yards, while South Korea’s Hanwha is aggressively competing for market share, leveraging geopolitical concerns, specifically U.S./China relations.

Meanwhile, even the shipyards that dominate the FPSO sector are actively weighing their options, as shipyards must weigh the size and particularly the length of FPSO contracts against more profitable alternatives like gas carriers. “FPSOs take a lot of steel; they're big; they take up a ton of space. I can probably build three, maybe four gas carriers per square meter of dry dock space versus one FPSO; so I'm making more money building gas carriers than I am building FPSOs,” observed Tremblay.

FPSO Building Yards

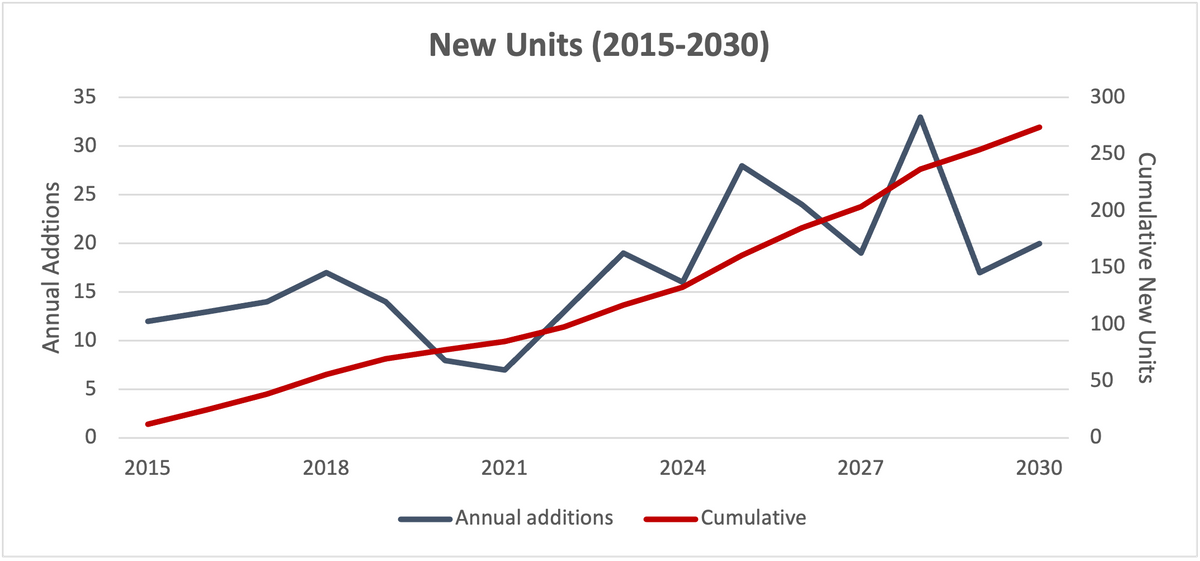

The following chart shows FPSOs, FLNGs, FPSs (semis, TLPs, spars and barges) and FSO/FSUs. An average of 13 units were added annually in 2015-2020. The booked and forecast units for 2021-2025 represent an average of 20 units per year, from which we infer a more active market.

NEW FLOATING PRODUCTION AND/OR STORAGE UNITS IN 2015-2030 PERIOD

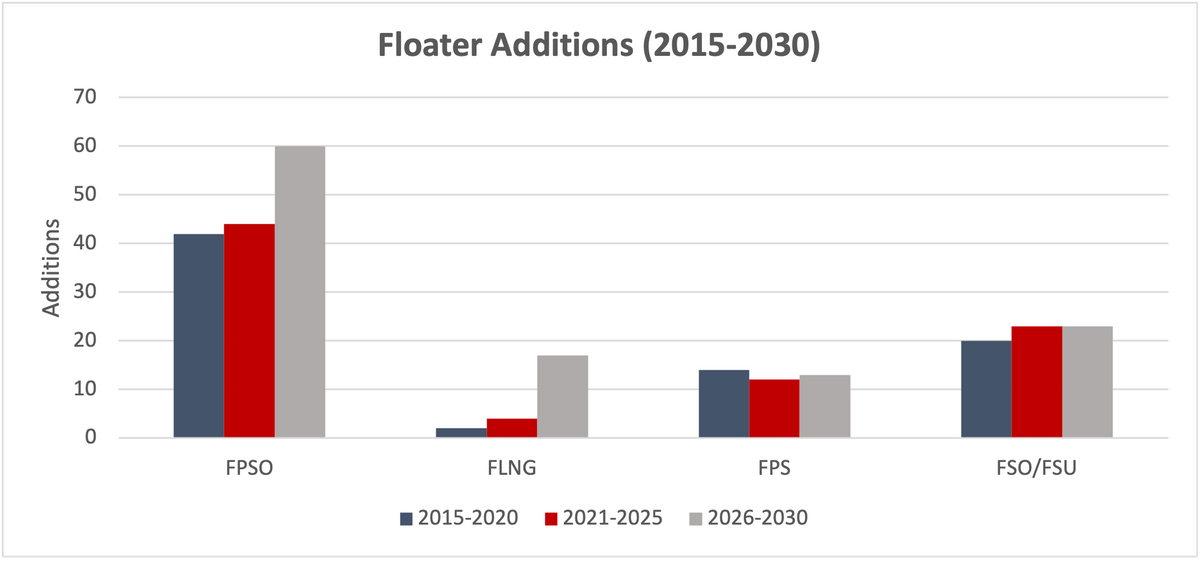

Other floater segments, FPSOs are the largest as shown below.

FLOATER ADDITIONS IN 2015-2030

New builds account for slightly over 50% of all new floaters, the balance being conversions and upgrades of existing units.

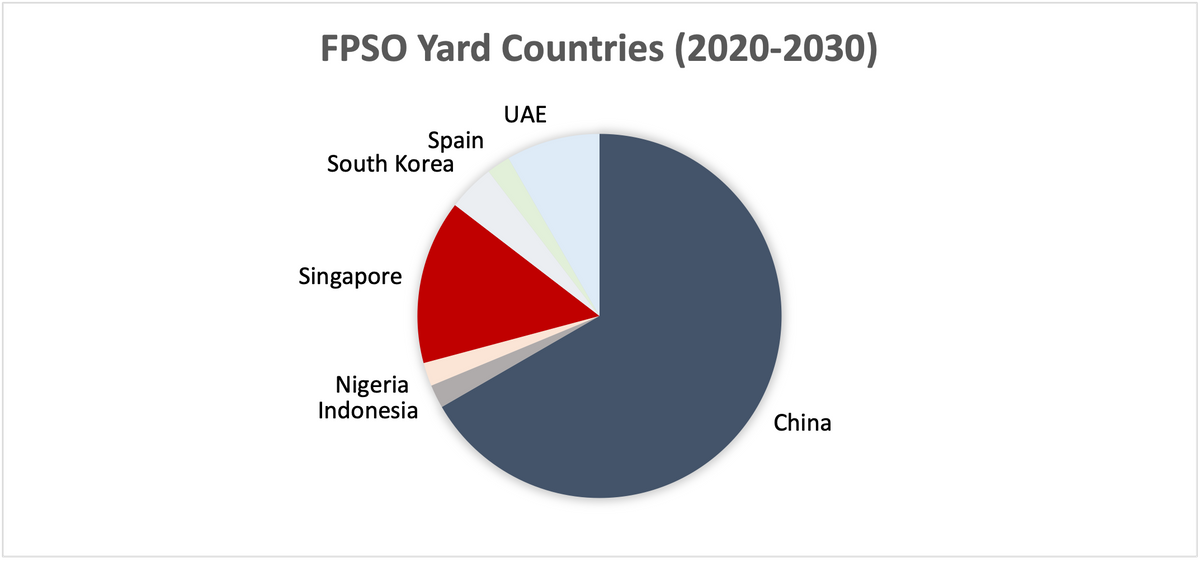

According to data from Intelatus, Chinese yards are currently forecast to build or convert two thirds of declared FPSOs in 2020-2030. Singapore is a far second place with ~15% share and the UAE in third place with ~8%. COSCO (~20% share), CIMC Raffles (~15% share), CMHI (~13% share), CSSC yards (~8%) and COOEC (~7%) are the main Chinese FPSO building and conversion yards. COSCO, CMHI and COOEC also have non-FPSO floater orders.

Seatrium, bringing together the history of Sembawang and Keppel, has an FPSO market share similar to CMHI (~15%), but is also a significant player in other floater segments with nine confirmed projects in the period.

Dubai Drydocks has an~8% FPSO share in the period and also a significant capture of other floaters with six confirmed projects.

SBM Offshore's Fast4Ward program, which builds standardized FPSO hulls on spec, helps to shorten delivery timelines, bringing newbuilds below the traditional 36–40 months to 24-27 months. The benefits of standardization have been demonstrated across many industries, but achieving it on an FPSO is challenging. Much of the topside equipment needs to be customized to each field’s specific characteristics including reservoir pressures and fluid composition.

The Fast4Ward concept, developed in 2015, therefore focuses on standardization of the hull, says Alexander Glenn, Chief Operating Officer of SBM Offshore. Beyond that, rather than macro standardization, smaller elements such as light fittings and handrails are standardized. Within each customer’s requirements, further standardization is possible too, and SBM Offshore tends to use the same contractors, making gains in quality, timeliness and safety by standardizing their supply chain.

The first Fast4Ward contract was awarded in 2019. Since then, SBM has had three contracts in Brazil, four in Guyana and one in Suriname. Six have been delivered and three are under construction. The floaters are generally built in HWS Shanghai Waigaoqiao Shipbuilding or CMHI, with topside integration then occurring at a range of yards globally including BOMESC, Seatrium, CMHI and COSCO.

Drilling down to FPSO yards

Chinese yards are currently forecast to build or convert two thirds of declared FPSOs in 2020-2030. Singapore is a far second place with ~15% share and the UAE in third place with ~8%.

FPSO YARD COUNTRIES

“Something that we’ve been focusing on is to deliver very complete and commissioned products. These projects are not pushed off the quayside at the earliest opportunity. We want to make sure that they’re fully commissioned and ready for operation.”

Glenn cites the example of the Prosperity FPSO in Guyana. “She sailed away from Singapore about two years ago and has been recordable-incident-free. She achieved first oil in line with the customer’s schedule expectations, and only 30 days after first oil, she achieved gas injection. This meant that we could stop the flaring associated with the initial startup. Only 40 days after that, she was up to full production capacity, and since startup, she has achieved an uptime of over 99.5%.”

What we are seeing in the market is a steady increase in size and complexity, says Glenn. “In 2015, topsides typically weighed around 20,000 tons, we’re now looking typically at 45,000 tons. That’s typically the result of increasing capacity requirements. These assets are around 200,000 barrels of oil per day and about 400 million cubic feet of gas handling a day. In addition, we now have efforts to reduce carbon intensity which brings additional technology onto these assets, driving up topside weight.”

This means more newbuild FPSOs, and more opportunities for Fast4Ward. It’s a trend Glenn sees continuing with the increase in oil and gas developments off South America and West Africa. These regions have very deep water, very large and very productive reserves, and that productivity brings a lower carbon intensity and lower costs per barrel for developers.