Markets

Asia Offshore Wind

Geopolitics and Climate Change: Development of Offshore Wind in East Asia and Pacific

By Alisa Reiner

The East Asia and Pacific (EAP) region is rapidly emerging as a global leader in offshore wind energy, a critical component of the clean energy transition. With its vast coastlines, growing energy demand, and ambitious decarbonization goals, the region is poised to play a pivotal role in shaping the future of renewable energy. However, this growth is unfolding against a backdrop of complex geopolitical tensions, economic challenges, and technological hurdles.

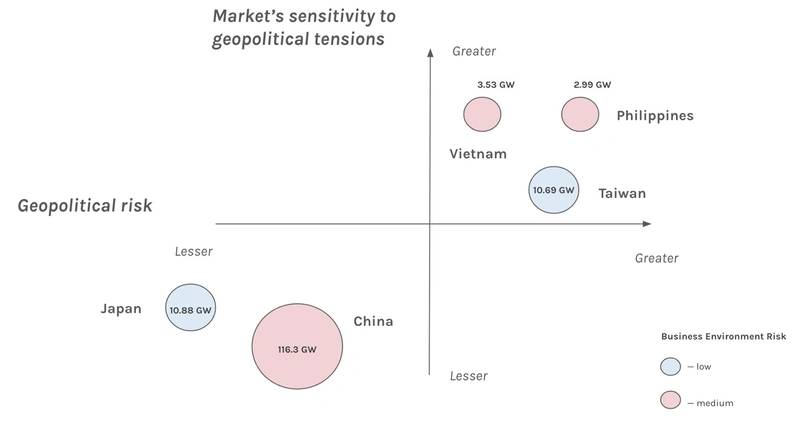

Five key markets, including China, Taiwan, Japan, Vietnam, and the Philippines, demonstrate the opportunities and challenges facing offshore wind development in the EAP region. These nations are not only at the forefront of offshore wind innovation but also at the intersection of competing maritime claims and geopolitical interests.

The Growing Importance of Offshore Wind

Offshore wind energy has become a cornerstone of global efforts to combat climate change and reduce reliance on fossil fuels. Unlike onshore wind farms, offshore installations can harness stronger and more consistent winds, making them ideal for densely populated coastal regions.

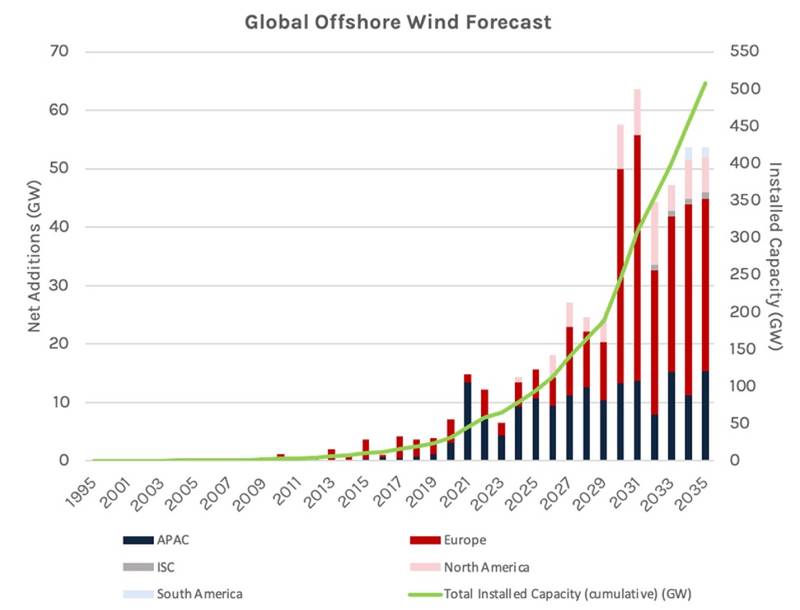

Globally, offshore wind capacity stood at about 75 GW in 2023 but is projected to grow exponentially to over 510 GW by 2035 and nearly 1,200 GW by 2050. This rapid expansion is driven by advancements in technology—particularly floating wind turbines that can operate in deeper waters—and increasing commitments from governments to achieve net-zero emissions targets.

The EAP region is at the heart of this transformation. By 2035, its cumulative installed offshore wind capacity is expected to reach approximately 144 GW. China leads the charge with aggressive targets and substantial investments, while Taiwan and Japan are steadily building their capabilities. Emerging markets like Vietnam and the Philippines are also beginning to explore their offshore wind potential.

China: The Global Powerhouse

China dominates the offshore wind landscape in EAP, with an installed capacity of approximately 37 GW as of 2024—more than any other country in the world. The nation’s ambitious renewable energy policies aim to expand this capacity to nearly 90 GW by 2030.

China's success is underpinned by its robust and vertically integrated supply chains, low-cost production capabilities, and significant government support. Coastal provinces such as Guangdong, Fujian, Zhejiang, Jiangsu, and Shandong are leading the way in developing offshore wind projects. Additionally, China is investing heavily in "deep-sea" wind farms, which require advanced floating turbine technology.

However, China's dominance also raises concerns about market dependencies and geopolitical risks. The country controls a significant portion of the global supply chain for offshore wind components, including rare earth minerals (REMs) essential for turbine production. This concentration of resources has prompted other nations to diversify their supply chains to reduce reliance on Chinese imports.

Taiwan: Balancing Opportunity and Risk

Taiwan has positioned itself as a key player in the offshore wind sector with an installed capacity of approximately 3 GW as of 2024. The island's government has set ambitious targets to achieve up to 55 GW of offshore wind capacity by 2050 as part of its Net-Zero Roadmap.

Offshore wind is critical for Taiwan’s energy security. Currently, 98% of its energy is imported, making the island vulnerable to supply disruptions. Offshore wind offers a pathway to reduce dependence on fossil fuels while supporting Taiwan's energy-intensive semiconductor industry—a global leader in advanced chip production.

Yet Taiwan's geopolitical situation poses significant challenges. Tensions with China create risks for infrastructure projects near contested waters in the Taiwan Strait. International investors have expressed concerns about these risks, leading to higher insurance premiums and potential delays in project timelines. Despite these challenges, Taiwan remains an attractive market due to its favorable incentives and strategic importance in the global renewable energy landscape.

Japan: Floating into the Future

Japan’s unique geography—characterized by deep coastal waters—makes it an ideal candidate for floating offshore wind technology. While Japan’s current installed capacity is modest at just 0.3 GW, its government aims to achieve up to 45 GW by 2040.

Japan has pioneered floating wind technology with several demonstration projects already operational. These innovations could unlock vast areas for development far from shorelines where traditional bottom-fixed turbines are not feasible. However, high costs and regulatory barriers have slowed progress. Japan also faces grid integration challenges due to its isolated electricity network split between two frequencies (50 Hz in eastern and 60 Hz in western regions).

To overcome these hurdles, Japan is strengthening partnerships with European firms while investing in domestic manufacturing capabilities. With steady annual additions projected through 2035, Japan's offshore wind sector is poised for gradual but significant growth.

Vietnam: Untapped Potential

Vietnam boasts high technical potentials for offshore wind—an estimated 599 GW—yet its installed capacity remains negligible. The government’s Power Development Plan VIII targets up to 6 GW by 2030 and over 70 GW by 2050, although only around 3.5 GW of offshore wind capacity is realistic by 2035 given the current project pipeline.

Vietnam’s South Central region offers attractive conditions for bottom-fixed turbines due to shallow waters near existing port infrastructure. However, regulatory uncertainties and insufficient grid capacity have hindered progress. International developers have been cautious about entering Vietnam’s market due to unclear policies and high investment risks.

Despite these challenges, Vietnam’s extensive experience in offshore oil and gas could provide a foundation for developing its offshore wind industry if regulatory support to attract foreign capital is implemented.

The Philippines: A High-Stakes Frontier

The Philippines also has significant potential for floating offshore wind due to its deep waters and fragmented geography comprising over 7,000 islands. The country’s technical potential stands at approximately 178 GW.

Offshore wind could address several pressing issues for the Philippines: reducing reliance on imported fossil fuels, alleviating land-use conflicts for energy development, and enhancing energy independence amid volatile global markets.

However, like Vietnam, the Philippines faces significant obstacles including regulatory inefficiencies and limited local supply chain capabilities. Recent government initiatives, such as streamlined permitting processes, offer hope for accelerated development.

The first commercial-scale projects are expected online by 2030 with gradual growth thereafter.

Geopolitical Challenges: Navigating Troubled Waters

Offshore wind development in EAP does not exist in a vacuum—it is deeply intertwined with regional geopolitics:

-

Territorial disputes: Competing claims over maritime territories, such as the Pratas Islands, Paracel Islands, Spratly Islands, and Macclesfield Bank the South China Sea, create risks for infrastructure projects near contested waters.

-

China’s strategic dominance: China’s assertive actions, including militarization of artificial islands in the East and South China Seas, raise concerns about security vulnerabilities for neighboring countries.

-

Supply chain and investment leverage: Heavy reliance on Chinese components exposes other nations to economic coercion or trade disruptions in case of potential disputes. Further, China’s investment in its neighbors’ infrastructural development creates asymmetric dependencies. For instance, the State Grid Corporation of China owns a 40% stake in the National Grid Corporation of the Philippines, which could become a threat to the latter’s national sovereignty and energy security.

-

Cybersecurity risks: Increased offshore wind farms’ technological sophistication and reliance on digital control systems makes them vulnerable to cyberattacks that could disrupt operations or compromise national grid stability.

Looking Ahead: Offshore Wind Development Opportunities

Despite geopolitical complexities and technical hurdles, the outlook for offshore wind in EAP remains promising:

-

Technological advancements: Innovations in floating turbines and energy storage solutions will unlock new opportunities across deep-water regions, most notably Japan and the Philippines.

-

Policy support: EAP governments are increasingly prioritizing renewable energy through strategic plans, favorable policies, and incentives aimed at attracting foreign developers and investors.

-

Diversification: Partnerships with European original equipment manufacturers (OEMs), developers, and suppliers could enhance supply chain resilience and decrease reliance on Chinese imports.

Going forward, China, despite rising geopolitical tensions with regional neighbors and the United States along with domestic economic challenges, will continue leading the charge due to its scale and cost advantages. Japan and Taiwan’s markets are projected to grow steadily with increased technological expertise, especially for offshore technologies, and diversification of supply chains and capital sources to include European partnerships. Emerging markets like Vietnam and the Philippines must overcome regulatory bottlenecks to attract investment while balancing geopolitical risks and dependencies on Chinese investments.

In EAP, offshore wind holds immense promise as both an engine of economic growth and a pillar of sustainable development—provided nations can navigate turbulent waters ahead.

About the Author

Alisa Reiner is a second-year Master of Environmental Management student at Yale, specializes in energy geopolitics, markets, and security, with experience in energy research and consulting.

- i "Country Risk Ratings & Reports," Allianz Trade, accessed December 4, 2024, https://www.allianz-trade.com/en_US/resources/country-reports.html.